Introduction

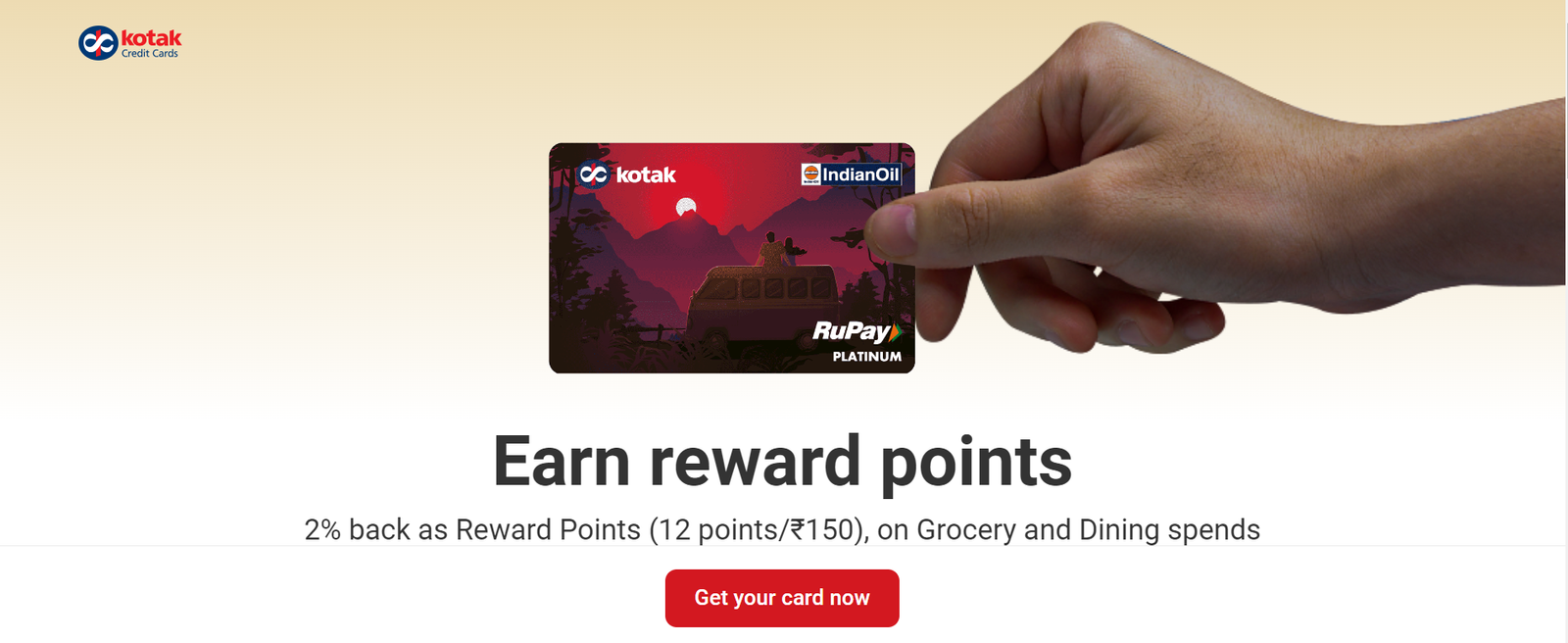

The Indian Oil Kotak Credit Card is a versatile choice for fuel savings and lifestyle rewards. With a nominal joining fee of INR 449, the card offers 4% back on fuel spent at Indian Oil outlets and 2% on groceries and dining. Enjoy a 1% fuel surcharge waiver for transactions between INR 100 and INR 5000, and benefit from a personal accident insurance cover of INR 2,00,000. New users earn 1000 Reward Points after spending INR 500 within the first 30 days. With no annual fees, this card combines value and convenience, making it an ideal pick for savvy consumers.

Category

Fuel , Rewards

Minimum Credit Score Required

750

APR

42% annual percentage rate

Features

- 12 Reward points per INR 150 on grocery and dining.

- 24 Reward points per INR 150 at IndianOil outlets.

- 3 Reward points per INR 150 on other spends.

Welcome Offer

- Spend INR 500 or more within 30 days of issuance to earn 1000 Reward Points.

Card Fee

Annual Fee

Joining Fee

Foreign Transaction Fee

3.50%

*Applicable Taxes

Fraud Liability

N/A

Expert Review

Rating:

Advice from our Experts

Unveiling the Indian Oil Kotak Credit Card – a harmonious blend of rewards and travel benefits. Earn 12 points on grocery/dining and 24 at IndianOil outlets for every Rs. 150. Enjoy a 1% fuel surcharge waiver and INR 2,00,000 personal accident insurance. Experience rewards and travel, seamlessly integrated.

IndianOil Kotak Credit Card Eligibility Criteria

18-65 Years

Minimum & Maximum age of the applicant

30000

Minimum monthly income

500000

ITR(For Non-Salaried Person)

750

Minimum Credit Score

Indian Oil Kotak Credit Card Overview

Fuel Your Rewards, Drive to Savings.

The Indian Oil Kotak Credit Card presents an alluring array of benefits, making it an ideal choice for discerning shoppers and frequent spenders. With no annual fees for a lifetime, this card ensures a hassle-free experience for cardholders. Its generous Reward Points program offers 4% back on Indian Oil fuel spends, 2% on grocery and dining expenses, and 0.5% on all other purchases, turning everyday transactions into rewarding opportunities.

Fuel up confidently and save with a 1% fuel surcharge waiver on transactions ranging from INR 100 to INR 5000 at IndianOil outlets, capped at INR 100 per statement cycle. Moreover, enjoy a personal accident insurance cover of INR 2,00,000, adding an extra layer of security.

Emphasising a warm welcome, the Indian Oil Kotak Credit Card provides new cardholders with 1000 Reward points upon spending INR 500 within the initial 30 days of card issuance. With a credit score requirement of 750 & above, this card offers an affordable joining fee of INR 449 and an annual fee of INR 449. Being one of the best Kotak Bank credit cards in India, it offers foreign transaction fees of 3.50%, bringing convenience and value to international transactions.

Indian Oil Kotak Credit Card Features & Benefits

Discover the Indian Oil Kotak Credit Card. This multifaceted financial tool offers a slew of advantages, designed especially for those who frequent Indian Oil fuel stations. From fuel rewards to lifestyle benefits, this, being one of the best credit cards in India, amalgamates savings and conveniences, offering you the best of both worlds.

Indian Oil Kotak Card Fee Waiver Benefit

Don’t worry about annual fees eating into your savings. The Indian Oil Kotak Card, Fee Waiver Benefit, ensures you get more than what you pay for. By meeting specific spending criteria, you can enjoy a waiver on the annual fee, making this card even more appealing.

- Spend INR 50,000 or more and get the annual fee of INR 499 waived.

Indian Oil Kotak Card Insurance Benefit

With the Indian Oil Kotak Credit Card, peace of mind comes standard. The card includes valuable insurance benefits, covering everything from accidental death to lost luggage. You’re not just spending; you’re also investing in your security every time you swipe.

- Obtain a personal accident insurance cover of INR 2,00,000.

Indian Oil Kotak Card Additional Benefits

Enhance your financial flexibility with a host of additional benefits that come with the Indian Oil Kotak Card. From EMIs to balance transfers, this card is packed with features that make managing your finances simpler, smoother, and more efficient.

- RuPay contactless transactions up to INR 5000.

- Enjoy the personal concierge and assistance for all your needs.

- Get the add-on card for your family members to share the benefits.

- Easily track the spends of each card separately.

Best Lounge Access Credit Card | Best Rewards Credit Card | Best Cashback Credit Card

IndianOil Kotak Credit Card Reward Benefits

The Indian Oil Kotak Credit Card stands as one of the best rewards credit cards in India. Earn points quickly on everyday expenses like fuel and shopping, making every transaction more rewarding. The main benefits that you will get are as follows:

- For IndianOil Fuel Spends, you earn 4% back as reward points, equating to 24 reward points for every INR 150 spent, up to a limit of 1200 reward points per statement cycle.

- For Grocery and Dining expenses, you earn 2% back as reward points, equating to 12 reward points for every INR 150 spent, up to a limit of 800 reward points per statement cycle.

- On all other spends, you earn 0.5% back as reward points, which means you gain 3 reward points for every INR 150 spent.

Indian Oil Kotak Card Reward Redemption Benefits

Redeeming your points is simple and flexible, making it a standout choice for the best rewards credit card in India. Turn your points into cashback, fuel, or vouchers with just a few easy steps.

- Redeem Kotak Reward points as cashback.

- Call Kotak Customer Care at 18602662666 to redeem points.

- Minimum 300 points required; can be redeemed in multiples of 300.

- Processing within 2 working days; confirmation sent to registered contact.

- Redeem at a rate of 25p/point.

- Categories for redemption include merchandise, e-vouchers, movie vouchers, travel, and mobile recharge.

- Conversion of Kotak Reward points into IndianOil XTRAREWARDS Points can be done via Mobile or Net Banking.

- 300 Kotak Reward Points = 250 IndianOil XTRAREWARDS Points = INR 75 value.

- For managing XTRAREWARDS Points, visit xtrarewards.com.

Indian Oil Kotak Credit Card Fuel Benefits

Fuel up your vehicle and your savings with the Indian Oil Kotak Credit Card, one of the best fuel credit cards in India. Enjoy exceptional fuel benefits such as cashback, surcharge waivers, and bonus points. Make each journey both economical and rewarding right from the moment you turn the ignition.

- Get a 1% fuel surcharge waiver on transactions between INR 100 to INR 5000.

- The maximum surcharge waiver of INR 100 per statement cycle.

- This is applicable only at IndianOil outlets.

Indian Oil Kotak Credit Card Fees & Charges

Transparency is key when it comes to credit card usage, and the Indian Oil Kotak Credit Card makes no exception. Get to know all your fees upfront so you can manage your expenses wisely. From cash advance fees to late payment charges, you’re always in the loop.

Cash Advance per INR 10000: INR 300

Over Limit Penalty: INR 500

Minimum Repayment Amount: 5% or 10% of the total amount due as per bank policy

Card Replacement Fee: INR 100

Late Payment Fees

- From ₹100 to ₹500: ₹100

- From ₹500.01 to ₹5000: ₹500

- From ₹5000.01 to ₹10000: ₹500

- Above ₹10000+: ₹700

Document Required for Indian Oil Kotak Credit Card

To apply for the Indian Oil Kotak Credit Card, you’ll need to provide proof of identity (PAN card, Passport, Driving Licence, Aadhaar card), proof of income (IT Return, latest payslip, or Form 16), and proof of residence (Passport, electricity bill, or Ration Card).

How to check Indian Oil Kotak Credit Card Application Status

To check the status of the Indian Oil Card you applied for, you can connect with customer care or visit the bank. You can also check the status online by using this link